We connect to brokers

Leave the infrastructure to us

Crypto spot tradingNative support

Fully-embedded infrastructure

Other asset classesExtended support

Leverage the best of our tools

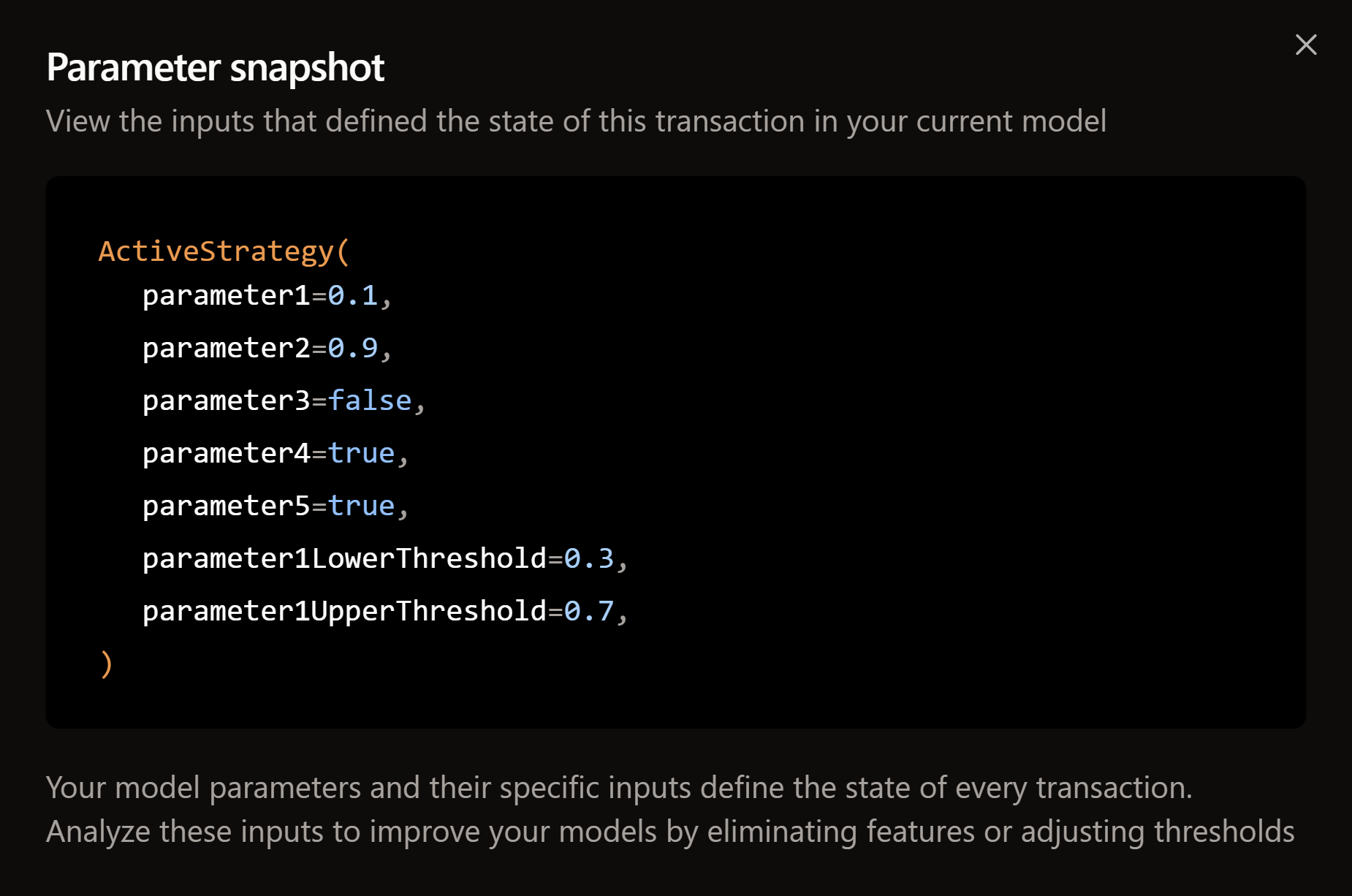

Synapse Data Sources

The all-in-one solution enabling powerful quant research by managing the data sources that you use across your portfolios

D

A

T

A

+

R

E

S

E

A

R

C

H

Whether you're pulling a machine-learning model from Hugging Face or using Alpha Vantage for additional real-time data, Synapse Data Sources opens opportunities for signal generation from multiple sources.

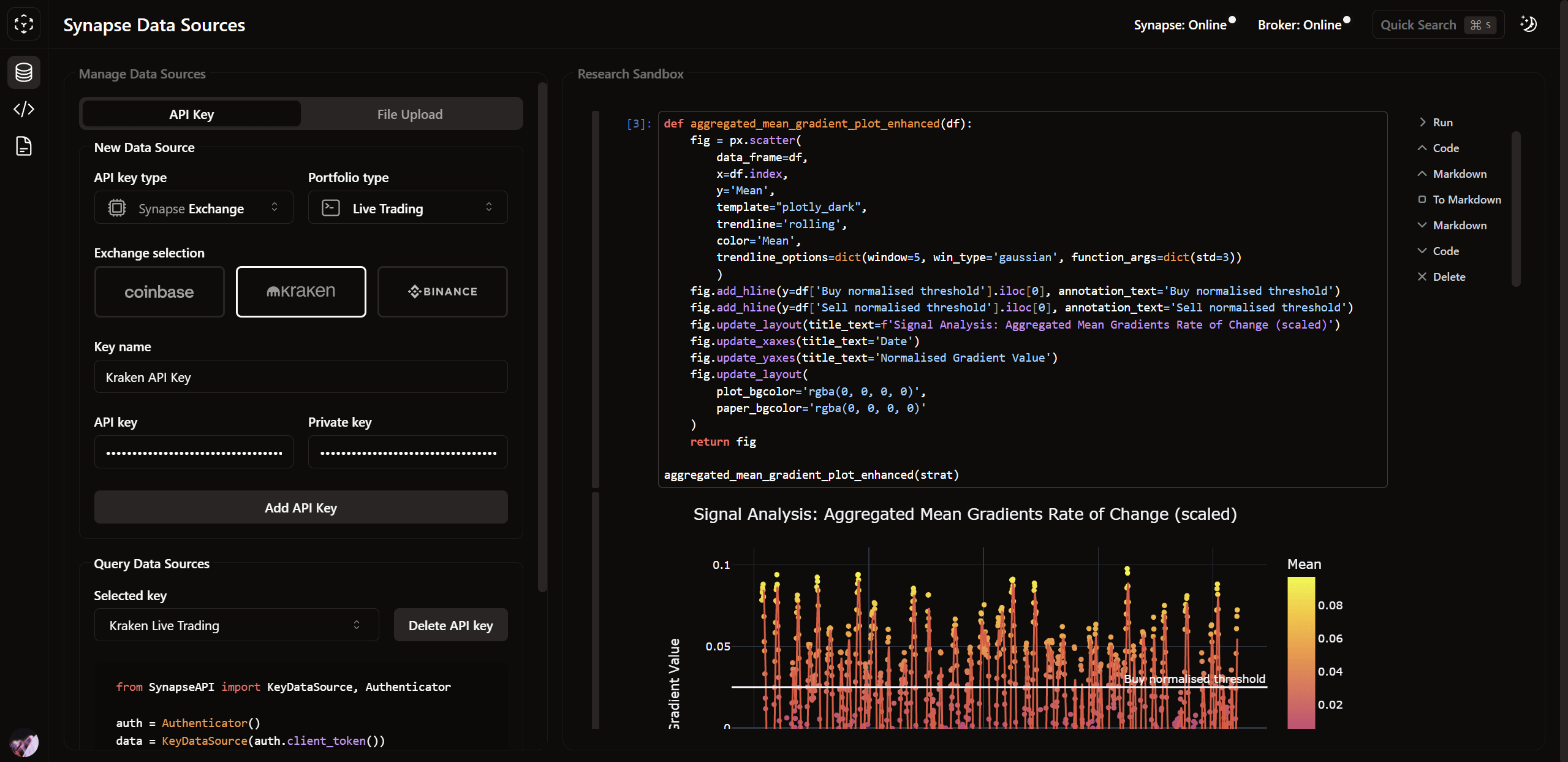

Strategy Terminal

Craft and deploy sophisticated trading strategies through an in-app Jupyter Notebook leveraging the Synapse API

1

Leverage Familiar Tools

Once a strategy is deployed, Synapse automatically processes transactions and delivers real-time trading and portfolio analytics

2

Quant Trading Turbocharged

With an integrated TradingView chart, benefit from a familiar setting by exploring strategies through the industry's best chart solution

QUANTITATIVE

ANALYTICS

ASSET

MANAGEMENT

A

S

S

E

T

M

A

N

A

G

E

M

E

N

T

R

O

B

U

S

T

R

I

S

K

M

A

N

A

G

E

M

E

N

T

1

Portfolio-Driven Trading

Every portfolio is equipped to manage a collection of traded asset pairs while delivering aggregated performance insights. Switch between individual or aggregated asset insights system-wide.

2

Powerful Allocation

Specify allocation multipliers to control the distribution of your account balance across traded asset pairs. Go one step further by specifying an actively managed fund allocation to determine the percentage of capital that is actively traded across asset pairs.

3

Dedicated Risk Management

Choose between market, stop-loss, and trailing stop-loss orders and specify your risk-reward ratio. Get specific by defining unique settings for long and short positions.

4

Leverage Centralized Navigation

Enjoy one-click access from anywhere within Synapse. Asset Management is portfolio-wide, making AUM setting easily accessible across all portfolio views.

5

Rapid-Fire Updates

Modify your account settings effortlessly from any part of the platform. The quick access feature ensures that you can make changes to your trading settings without navigating through multiple menus, saving time and improving efficiency.

A

S

S

E

T

M

A

N

A

G

E

M

E

N

T

R

O

B

U

S

T

R

I

S

K

M

A

N

A

G

E

M

E

N

T

1

Portfolio-Driven Trading

Every portfolio is equipped to manage a collection of traded asset pairs while delivering aggregated performance insights. Switch between individual or aggregated asset insights system-wide.

2

Powerful Allocation

Specify allocation multipliers to control the distribution of your account balance across traded asset pairs. Go one step further by specifying an actively managed fund allocation to determine the percentage of capital that is actively traded across asset pairs.

3

Dedicated Risk Management

Choose between market, stop-loss, and trailing stop-loss orders and specify your risk-reward ratio. Get specific by defining unique settings for long and short positions.

4

Leverage Centralized Navigation

Enjoy one-click access from anywhere within Synapse. Asset Management is portfolio-wide, making AUM setting easily accessible across all portfolio views.

5

Rapid-Fire Updates

Modify your account settings effortlessly from any part of the platform. The quick access feature ensures that you can make changes to your trading settings without navigating through multiple menus, saving time and improving efficiency.

Automation

Synapse is built from the ground up with automation derived from manual trading

1

Automation

Synapse is built from the ground up with automation derived from manual trading

Skip the guesswork

Discover performance-critical algorithm data by diving into transaction states

2

Skip the guesswork

Discover performance-critical algorithm data by diving into transaction states

DEDICATED

DEDICATED

ALGO

TRADING

ANALYTICS

RESULTS

INSIGHTS

METRICS

REPORTING

ACTIONS

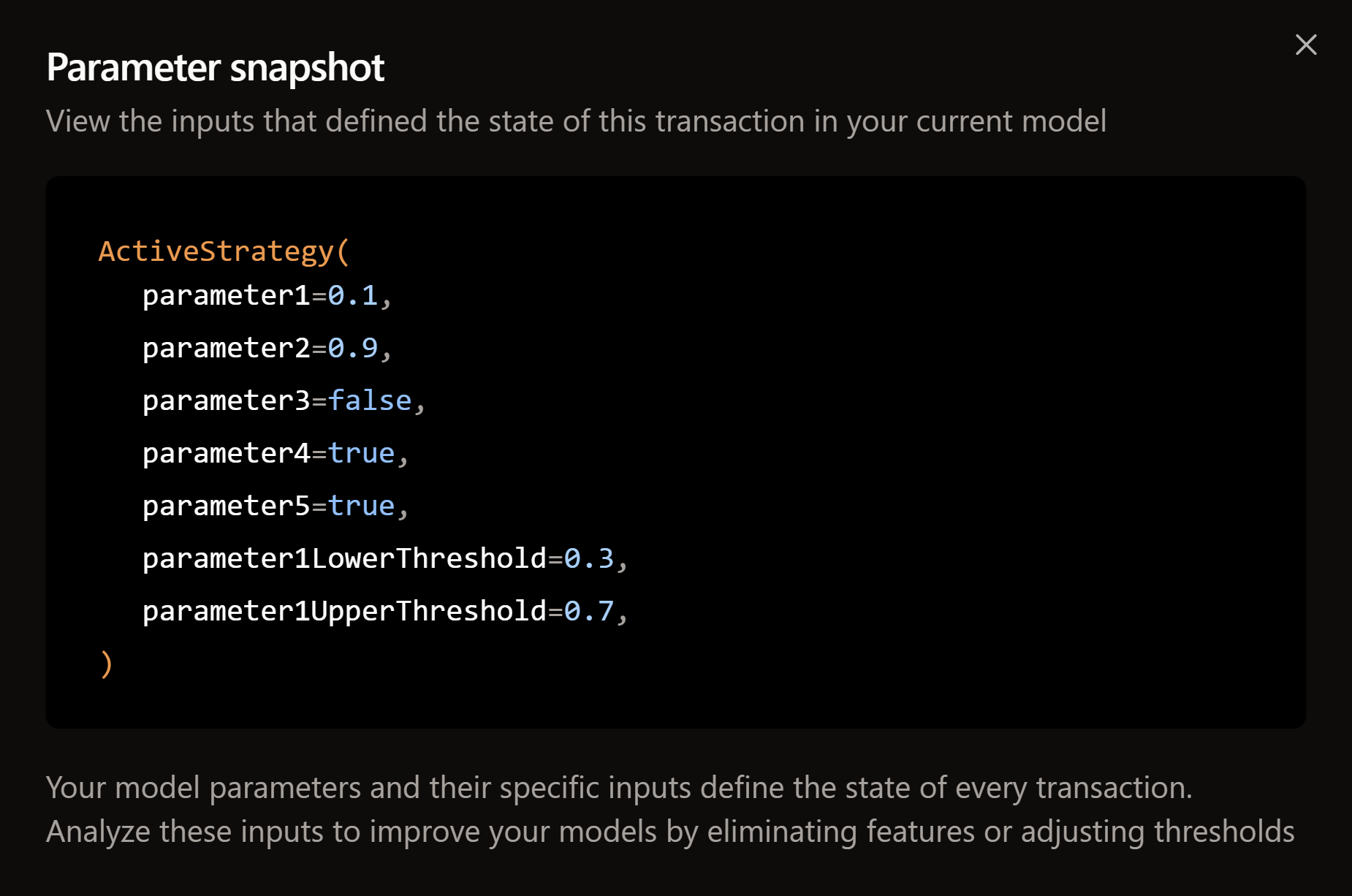

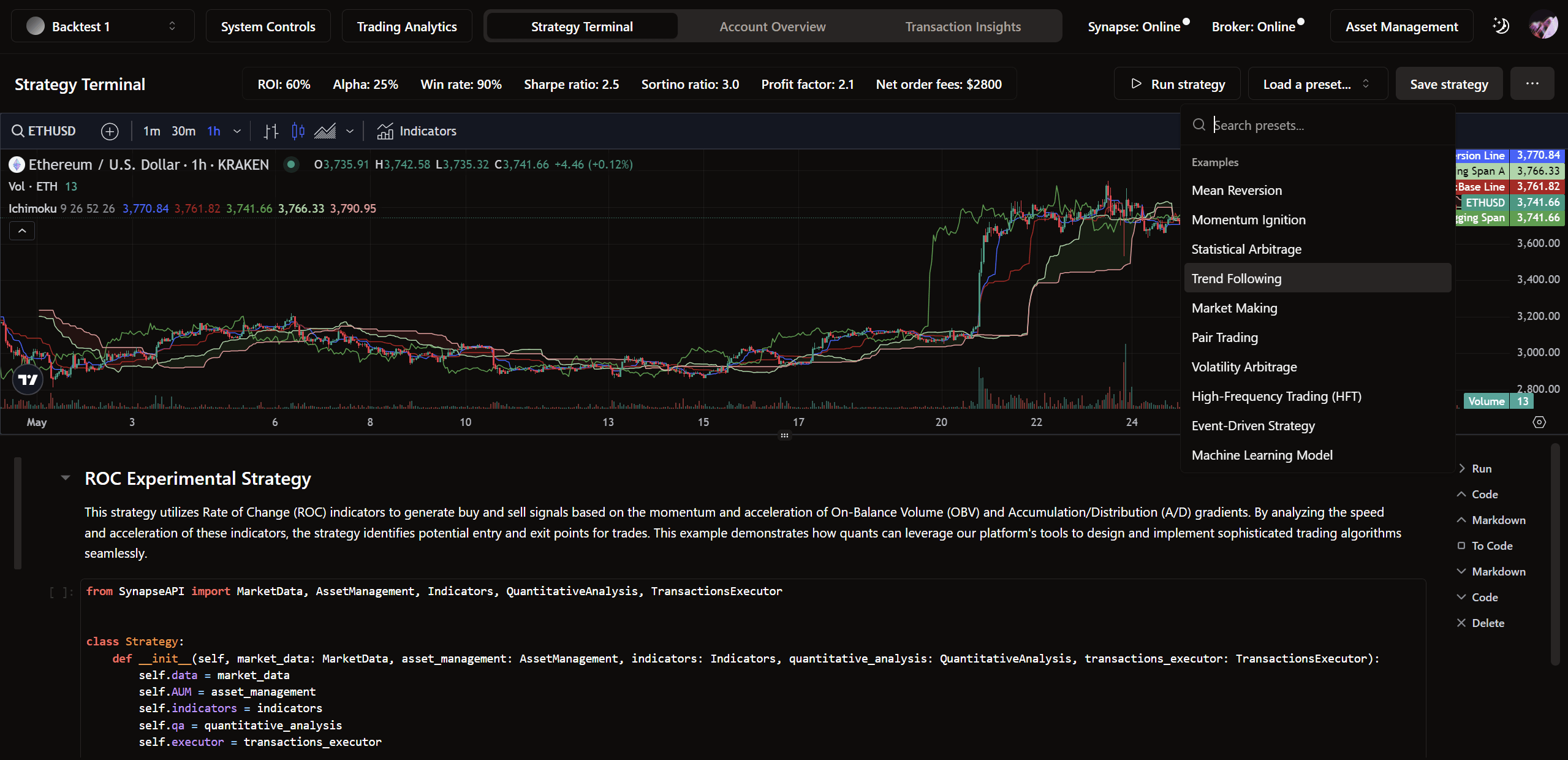

Parameter Snapshots

View the precise parameters that define every transaction, and make informed decisions on parameter optimization

Macro System Controls

System Controls

System Controls x Fast Navigation

Global Executive Actions

Make system-wide decisions through a pull-up System Controls panel for one-click manual intervention

Quick Search

Keep tabs on insights with an interface optimized for accessibility

Fast Navigation

Core insights are visible at all times on all pages, and secondary insights are one click away through the Portfolio Navigator

Fast Navigation

Core insights are visible at all times on all pages, and secondary insights are one click away through the Portfolio Navigator

End-to-end research + trading

Discover an all-in-one solution for developing, deploying, and maintaining fully automated trading systems by leveraging tools for quantitative analysis. From risk management to quantitative modeling, Synapse provides quantitative traders with a portfolio-driven, transparent algorithmic trading environment optimized for research and deployment.

Be the first to market.

Cover the complete pipeline of quant research + trading

Best for experimenting

Starter

$25

/month

1 portfolio / group

2 data sources

Basic compute memory

2 concurrent deployments

Best for experimenting

Starter

$25

/month

1 portfolio / group

2 data sources

Basic compute memory

2 concurrent deployments

Best for regular trading

Pro

$35

/month

4 portfolios / group

6 data sources

Elevated compute memory

4 concurrent deployments

Best for regular trading

Pro

$35

/month

4 portfolios / group

6 data sources

Elevated compute memory

4 concurrent deployments

Best for professionals

Expert

$50

/month

Unlimited portfolios / group

Unlimited data sources

Maximum compute memory

10 concurrent deployments

Best for professionals

Expert

$50

/month

Unlimited portfolios / group

Unlimited data sources

Maximum compute memory

10 concurrent deployments

Join the Waiting List.

Get early access to our platform and be the first to know when we launch.